Road to Recovery

Emergency Preparedness Kit

Do you have?

- Basic Liability Coverage

- Loss of Business Insurance

- Natural Disasters Coverage

- Water Damage Coverage

- Data Backed up

As hard as it is to imagine, what if the unthinkable happens and disaster strikes? Two retailers share their inspirational stories—the decisions they had to make and the lessons they learned in the wake of unforeseen events.

It was 3:00 a.m. on November 13, just weeks before last Christmas, when Jean Haller heard the sirens from her bedroom. Then she got the call bearing the bad news: Her store, Journeys of Life, just a couple of blocks away from home, was up in flames.

“When I arrived, they were taking hatchets to the windows,” says Haller, of her store in Pittsburgh, PA. Several investigations later, it was found a power strip behind the sales desk was to blame. “If a power strip is plugged into the wall, even if it is turned off, it can still malfunction,” says Haller, who was unaware of this fact at the time.

“When I arrived, they were taking hatchets to the windows,” says Haller, of her store in Pittsburgh, PA. Several investigations later, it was found a power strip behind the sales desk was to blame. “If a power strip is plugged into the wall, even if it is turned off, it can still malfunction,” says Haller, who was unaware of this fact at the time.

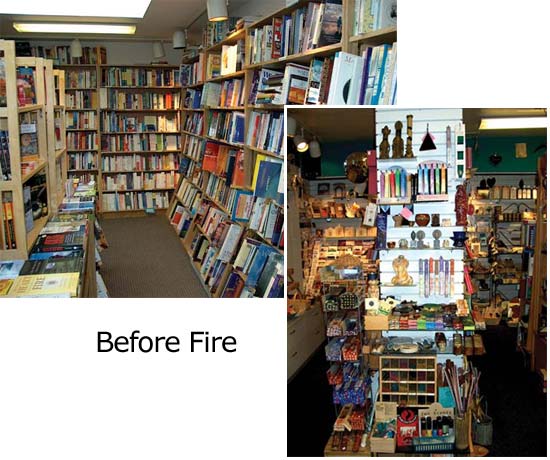

The damage was extensive. “We basically lost everything. Everything burned on the first floor, and on the second floor, heat and smoke damaged the rest,” Haller says. The first floor contained gifts such as jewelry, candles, crystals, music and journals; the second floor was a 20-year compilation of books on every subject from Judaism to depression, some out of print. The total cost of inventory: $250,000. The full amount of the claim, including building repairs, inventory replacement and loss of business totaled slightly over $500,000.

Haller admits that her first thoughts when she saw the smoke billowing out the windows was that she could get her money out and retire. But she realized she wasn’t ready. “Because of the community involvement we had, and the people we had served in our 22 years in the community, I didn’t want to go out that way,” she says.

Miracles happen

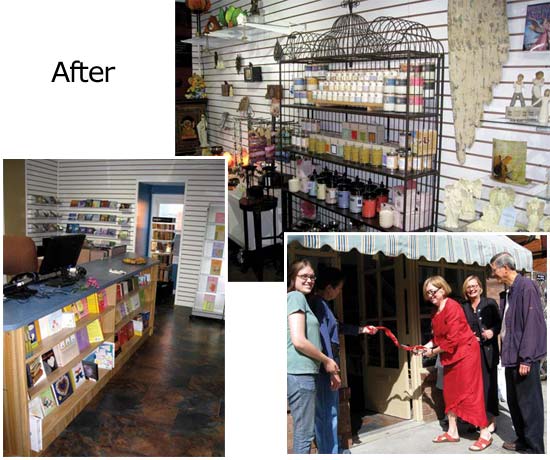

In a few hours, that very morning, the decision to move on was already gathering force. Haller would open a temporary location as her store was rebuilt. And that wasn’t even the challenging part. Haller wanted to open in just a few days’ time for Small Business Saturday, the day after Black Friday, an important holiday shopping day for every small business retailer.

Journeys of Life sold signs stating: “Miracles Happen.” Now one was about to. Volunteers came pouring in. Haller’s friend, Maggi Aebi, offered to oversee the painting and readying of the space and found a crew of 15 volunteers to make it happen. Local sales representatives dropped off merchandise and greeting cards, some from companies Haller didn’t even carry. SnapRetail, a national marketing program for independent retailers based in Pittsburgh, of which Haller is a member, sent eight employees for any task needed. “We also received monetary donations from a trade show principal, a retailer, an author and a customer,” says Haller. And lastly there was media support approximately three days before opening, with store coverage on two major television networks.

Less than two weeks after Haller’s store caught fire, she was open for business again on November 26, in a temporary location. When Small Business Saturday arrived: “You couldn’t move inside the store. That’s how many people were there,” she says. In this temporary space, she compiled a “Gratitude List”—names of people and businesses who had helped make the opening of the new location a reality.

What Haller received back from the community, she had been giving for over 20 years. “I have, the whole life of the store, been involved in the community, with drug and alcohol recovery programs, food pantries,” and many other community projects, she says. “All of these things are as much a part of the business as selling,” she adds.

Journeys of Life reopened in its original location roughly six months after the fire. In the end, a devastating turn of events became a blessing in disguise says Haller, with a new store, new inventory, new customers and a newfound commitment to strong fiscal planning.

The vanishing space

For six years Linda O’Boyle rented a storefront in the Regional Market Commons in Syracuse, NY. Her store, Metro Home Style, used to flood every so often due to poor building maintenance. When the Landmark Theatre, a grand old theater in Downtown Syracuse was undergoing a $16 million renovation with four new retail spots, O’Boyle saw an opportunity to set up shop in a new space. Even if one of the spots was very small, it “offered an opportunity to be downtown at an affordable price,” says O’Boyle. So she signed on the dotted line. On September 1, 2011, a lease was granted for an October 1 occupancy. “I gave 30 days notice to my landlord, notify customers, the press, and started a moving sale,” says O’Boyle.

For six years Linda O’Boyle rented a storefront in the Regional Market Commons in Syracuse, NY. Her store, Metro Home Style, used to flood every so often due to poor building maintenance. When the Landmark Theatre, a grand old theater in Downtown Syracuse was undergoing a $16 million renovation with four new retail spots, O’Boyle saw an opportunity to set up shop in a new space. Even if one of the spots was very small, it “offered an opportunity to be downtown at an affordable price,” says O’Boyle. So she signed on the dotted line. On September 1, 2011, a lease was granted for an October 1 occupancy. “I gave 30 days notice to my landlord, notify customers, the press, and started a moving sale,” says O’Boyle.

But it soon became clear that the theatre was behind in their renovations. The turnover date for the store was pushed out. When granted access to the space, O’Boyle discovered that the square footage was not as advertised. “It’s not even what the tax records say it is. The space that was small to start with has shrunk,” she says.

Luckily, she regained square footage by expanding into the next space that had not yet been rented. On September 26, O’Boyle’s real estate agent called a meeting with those involved to discuss how to move forward. “At the meeting, it becomes evident a lot of what the leasing agent told us is incorrect,” says O’Boyle. The Executive Director informed her that the space next to O’Boyle’s was zoned for condominium use even though it was a retail space. So she would have to pay condo fees, in addition to taxes and rent. There were other problems too and in the end, it became increasingly apparent that O’Boyle could not use the space. “It was [the all-important] fourth quarter and I was basically out of business,” she says.

The hunt for a new space was now on. On October 12, the perfect storefront was found in a warehouse district adjacent to Downtown Syracuse called Franklin Square. The lease was signed in less than 24 hours, says O’Boyle.

Support poured in from all directions: friends and family helped get the new store ready, customers delivered postcards announcing the new location, and journalists covered the opening. “Journalist Bob Niedt from [the Syracuse Post-Standard] announced the move to the Landmark Theatre Building, and when that fell through, went out of his way to cover the new location and store opening. This really helped make people aware of the new location and helped drive new traffic,” O’Boyle says.

In tandem, O’Boyle ramped up her own marketing efforts. “Not only had I announced a move, and then changed the destination, but I had been closed for the entire month of October. That’s a long time to be off the radar and October is such a crucial selling month. As soon as I had the keys to the Franklin Square store, I started generating a buzz on the shop’s Facebook page. Customers became involved in the renovation process and followed the progress,” she says.

“I continued the marketing efforts into Small Business Saturday and our sales were up 91% over Small Business Saturday 2010,” says O’Boyle.

The marketing momentum continued, as did the sales, straight through the holidays. “I knew there was a huge risk of losing holiday sales because I pulled up stakes at the beginning of the season, but my marketing efforts paid off. The customers came and they have continued to come,” she says.

Happy outcomes

For both retailers, there were some unexpected positive results. “The store in Franklin Square is over twice the size I had at the Regional Market Commons, and more than double what I had contracted for in the Landmark Theatre building,” says O’Boyle. This increase has allowed her to expand to some new categories, such as personal accessories and gourmet, as well as a new pet boutique.

Jean Haller tested new merchandise and learned her customers are willing to spend a little more for something different. “Kristin Ford sent us her jewelry on consignment with a $50-$100 retail. We put it out and sold it all in six weeks,” Haller says.

Because of the tight quarters in the Journeys of Life temporary location, Haller learned the art of cross-merchandising, which she has taken back to her original location.

Risk assessments

You cannot foresee the future, but make sure to assess what the risks to your business are and plan accordingly, advise industry experts. The primary question to ask is: “If disaster struck, do I have enough money to replace everything?”

Insurance plans are targeted individually to each retailer’s needs and risk tolerance, says Lizabeth Shahinian, president and owner of Shahinian Insurance Services, Inc. in Santa Ana, CA. “It comes down to their comfort level and how much risk they can sleep with at night,” she says.

“We have a broker who tells us every year we need to increase our coverage based on our dollar amount of inventory,” says Jean Haller. Haller’s coverage included Loss of Business insurance, which paid the rent and utilities for a temporary location, the renovations necessary to rebuild the original space, and the payment of employee salaries, when they were out of business. “It also pays for lost sales while the business is unable to be open and the difference between present and past sales while in a smaller, temporary location,” says Haller.

“Never assume something is covered,” advises Shahinian. For instance, standard insurance plans do not protect against floods and earthquakes. These are covered separately under government insurance plans.

The first and most basic layer of coverage is liability. This limit is set by the landlord. Basic liability coverage protects a retailer’s financial interest in the event they unintentionally cause harm to the public, says Shahinian. If retailers desire to protect their inventory, they add Business Personal Property insurance. This is based on the wholesale value of the inventory and includes store hardware and equipment, says Shahinian. Consider including a Loss of Income clause to be paid during the time the business might not be up and running as well, she says. Water damage is another add-on, protecting retailers from leaking toilets or sprinkler systems.

Take relocation, for instance. Where is your merchandise stored in the process? “As soon as I knew I was moving, I called my insurance agency, and when it became evident that I wasn’t moving into a storefront for a while and that my entire inventory would be stored at my house, I made sure it was covered in case of theft, fire, flood or other damage,” says O’Boyle. “When I signed the lease on the Franklin Square space, I called them again and we went over what coverage would be appropriate.”

With so many options in coverage, it is best to choose an insurance agent that deals specifically with commercial risk and one you trust.

“Make sure you are working with an agent that will back you up,” says Haller. “Our insurance agent was at our store at 9 a.m. on the day of the fire and had already called emergency services who were shortly on the scene boarding up windows,” she says, referring to her agent Bill Simpson of Simpson & McCrady in Pittsburgh.

In addition to insurance, have a backup of important files. “We had an online backup of our computer system of inventory. I would have been blown out of the water without that. I could give them an accurate estimate of our inventory. And I had extra copies of important tax records on the computer,” says Haller.

Albeit an important one, insurance is but one piece of the pie when disaster strikes. “Have a plan and also have a contingency plan. What exactly will you do if things don’t go the way you thought they would? Map it out and make sure you can make it work, while focusing on the needs of your business and customers, regardless of what [is] thrown your way,” says O’Boyle.

“Even when you do everything right, things can still go very wrong. And when they do go wrong, your first reaction might be to rush to the next solution. But you really need to try to step back and think about what is right for your business and your customers,” O’Boyle says.