Playing It Smart

For manufacturers and retailers in the toy industry product innovation and marketing are serious business.

Ten years ago, Kim Staller would never have predicted that E.A.T.S. Gifts in New York, would stock as many toys as it does now. “The interest in kids’ toys and games is ever growing. It’s what sells,” says Staller, buyer for the gift shop in Manhattan’s chic Upper East Side.

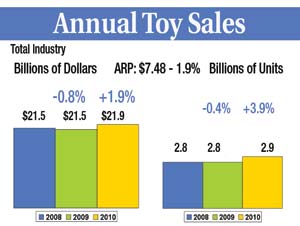

Indeed thanks to updates on proven performers, a deluge of innovation and a focus on key consumers, the toy market was strong heading into 2011. The industry made $21.87 billion in sales in 2010, posting a 2 percent uptick over the previous year, according to Port Washington, NY-based market research firm The NPD Group.

Reyne Rice, toy trend specialist with the Toy Industry Association trade group, attributes the surge in sales to an influx of toys with links to digital games. Leading the app/toy crossover are the new Angry Birds plush from Commonwealth Toys of New York and the Chocolate Fix and Rush Hour apps based on games by Alexandria, VA-based Think Fun. “For everyone who plays on their phone or iPad, those games are also popular in physical form,” she says.

A clear champion last year was the building sets segment. Rice attributes the boost to the products’ wide appeal. “Construction does well in a lot of age ranges, especially ages 6 to 12, and it’s good for boys and girls,” Rice says. To capitalize on this momentum, vendors have assembled an array of products that take building to the next level. For instance, the Q-BA-MAZE 2.0 from Roseville, MN-based MindWare allows kids to build their own marble runs, while HABA USA of Skaneateles, NY, plans to launch an update to its Technics block system that will create optical illusions and short animation via spinning blocks.

Plush was the year’s big winner, posting an 18 percent increase in sales. Staller prefers plush dogs in her store because there are so many varieties of canines, and people can’t resist them. Similarly, at Skookie, IL-based Poopsies gift shop, customers are likely to reach for offbeat plush like colorful aardvarks and hippos.

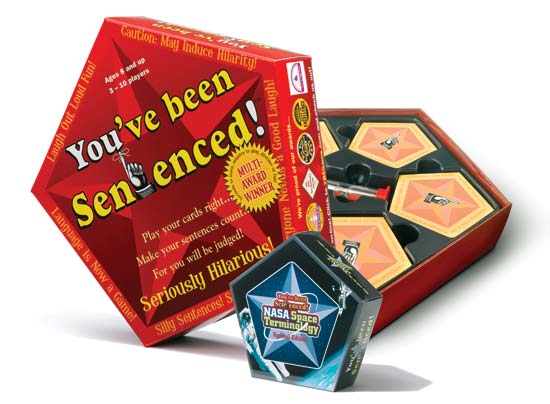

Though the game market experienced a 9 percent drop in sales in 2010, brands in this arena are rolling out a slate of inclusive, quick and travel-friendly products they hope will be fierce competitors in the coming months. One main focus is collaborative play, which encourages cooperation rather than besting opponents. For instance, in Forbidden Island from Newton-MA-based Gamewright, players work together to rescue treasures before the islands depicted on the tiles “sink.” Game developers are also cost conscious, offering mini games that fit easily into gift-giver budgets and absorbing raw material costs to keep retail prices in inline.

Plugged in

While all categories have been keen on innovating to survive, the industry as a whole is divided over how much technology is too much when it comes to children’s play. Some vendors have freely incorporated technology, adding bells and whistles to the physical product and developing online counterparts. Others, however, are puzzled over how to use the technology without compromising their core values.

While all categories have been keen on innovating to survive, the industry as a whole is divided over how much technology is too much when it comes to children’s play. Some vendors have freely incorporated technology, adding bells and whistles to the physical product and developing online counterparts. Others, however, are puzzled over how to use the technology without compromising their core values.

“One of the challenges our industry faces is the ability to accurately assess how online and mobile gaming affects sales of more traditional products, hence driving a change in the types of products produced,” states Sara Olson, Mindware marketing coordinator. The company’s toys, like it’s bestselling Qwirkle game, are strictly no-tech, but Olson says Mindware recognizes the trend toward electronics and computer tie-ins.

Similarly for P’kolino, which is known for high-quality wooden items, low tech has been precisely the point. The Dania, FL-based company has avoided technology in favor of allowing kids to come up with creative solutions through hands-on play with products like its multi-solution puzzles and geared shape sorters. But co-founder JB Schneider isn’t ruling out a move into the digital space. “Because online and digital technology is such a growing element of our culture, we’re trying to find the right ways to do it.”

Though Gamewright has always touted its products as “the anecdote to the over-plugged-in kid,” the company has begun to offer digital products. “It’s a challenge I wasn’t too worried about until I picked up an iPad and felt the power of the technology,” admits Jason Schneider, product development and marketing manager for the Newton, MA-based brand.

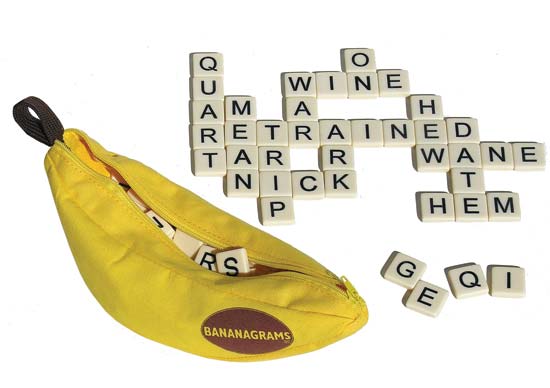

Noting that tablets can act like a game board, in that you can place it on a table and have people sitting around it rather than staring at a screen like you would with a game console, the company has embraced the iPad and plans to launch an app for its Forbidden Island game by the fall. Similarly Bananagrams offers iPad and Facebook apps for many of its games though the physical toys themselves adhere to the company’s “no batteries included” motto.

Noting that tablets can act like a game board, in that you can place it on a table and have people sitting around it rather than staring at a screen like you would with a game console, the company has embraced the iPad and plans to launch an app for its Forbidden Island game by the fall. Similarly Bananagrams offers iPad and Facebook apps for many of its games though the physical toys themselves adhere to the company’s “no batteries included” motto.

Pico Rivera, CA-based Aurora has embraced technology wholeheartedly because “kids love things that do something,” says marketing manager Tina Waldmier. To answer the call, Aurora has added sound in up to 50 percent of its plush offerings. The company’s characters like the popular Yoohoo & Friends collection can also be found in cyberspace, where children can play games designed to inform them about the animals they represent.

“[Having an online component] is almost expected. There’s so much online for kids to do now and so many other companies have tapped into that market for content geared toward young kids. What differentiates us our site is educational was well.”

For retailers, the question of which types of products to stock is complicated by the fact that toys have two audiences: the purchaser and the child. And often these two consumers are different things, according to Jackie Breyer, editor-in-chief of The Toy Book, a trade magazine that tracks the industry. “Kids want to know what something does because they’re used to that,” she says. “But sometimes parents want a traditional product that doesn’t make noise or need batteries.”

Back to basics

Even more than parents, too much technology can be a turnoff for another lucrative customer category: grandparents. With lots of time on their hands and disposable income in their pockets, these shoppers are top of mind for toy developers and retailers alike.

Even more than parents, too much technology can be a turnoff for another lucrative customer category: grandparents. With lots of time on their hands and disposable income in their pockets, these shoppers are top of mind for toy developers and retailers alike.

“We don’t specifically buy with grandparents in mind but they are one of the biggest gift givers out there,” states Alana Turner, co-owner of Poopsies gift store. “They like to feel that they can find something educational, hands-on and different so the kids will remember it. They want to see their grandchild light up.”

Schneider of Gamewright recognizes the demand for learning toys but doesn’t shoehorn lessons into his games. “Our products are educational with a lowercase ‘e’,” he says. “We try to build games that are fun to play, and have an educational quality, but it’s not the number one thing we tout.” Based on the popularity of its geography-based game, The Scrambled States of America, the formula seems to be working. The company will celebrate the game’s 10th anniversary next year with a deluxe edition.

Classic, quality products are at the heart of HABA USA’s offerings, which is why president Lea Cuillton says her collection is perfectly positioned to attract the indulgent customer. “Grandparents are looking for value in their purchases, HABA offers that value of quality German-made, heirloom toys. Our games offer open play value so that children young and old will enjoy continued play. Plus, game play goes quickly so grandparents can maintain the child’s interest for the duration.”

Grandparents aren’t just consumers, they also enjoy playing with their grandchildren. In response, brands like Bananagrams aim for intergenerational play when developing new toys. The company’s flagship product was developed by three generations, which explains why it’s equally well received from the classroom to retirement communities, according to president/owner Rena Nathanson. This fall, the company is releasing a jumbo version for outdoor play as well as a companion dictionary.

Grandparents aren’t just consumers, they also enjoy playing with their grandchildren. In response, brands like Bananagrams aim for intergenerational play when developing new toys. The company’s flagship product was developed by three generations, which explains why it’s equally well received from the classroom to retirement communities, according to president/owner Rena Nathanson. This fall, the company is releasing a jumbo version for outdoor play as well as a companion dictionary.

Folkmanis relies on nostalgia when it comes to wooing grands. “Most of our puppets appeal to grandparents already because the older generations grew up with puppetry,” states marketing director Elaine Kollias. “They know that puppets are an old-fashioned quality play-pattern that encourages creativity and imagination.” This year the company is introducing larger, higher-end puppets in response to the improving economy.

Grandparents are a key segment for Stekoa Creek Trading Company, which is nestled in Clayton, GA, a mountain community filled with retirees that receives an influx of visiting grandchildren in the summer. Co-owner Sally Word says, “For grands I get into practical gifty items like things I use. For instance, I stock the Blunders game by Successful Kids that teaches children manners. Grandparents eat that up,” she says.

Show and tell

Hoping that toys will just sell themselves is like rolling the dice on your financial future. Instead of leaving sell-throughs to chance, experts agree retailers need to step outside the box and encourage shoppers to engage with the product. “People often see a box and don’t want to read through 10 pages of instructions,” says Nathanson. “Make the toys accessible, and train your staff to explain games in 30 seconds.”

Hoping that toys will just sell themselves is like rolling the dice on your financial future. Instead of leaving sell-throughs to chance, experts agree retailers need to step outside the box and encourage shoppers to engage with the product. “People often see a box and don’t want to read through 10 pages of instructions,” says Nathanson. “Make the toys accessible, and train your staff to explain games in 30 seconds.”

Schneider of Gamewright agrees. “My mantra is games need to be played to be sold,” he says. “We don’t have the benefit of other toys where you can get the item just by looking at it.” Schneider has found that giving staff the opportunity to play the games is a win-win.

If they enjoy it, their excitement will be infectious, leading to increased sales.

“We interact a lot in our store and that’s one reason why toys and games do well with us,” reports Turner, listing Spotted by Blue Orange and Five Second Rule by Patch as top performers because they’re fast moving and inclusive of many skill levels. “Kids play the games in the store, and parents can see how excited their kids are.”

Aurora’s Waldmier notes that merchandising is also critical. While in the field doing market research, she noticed that successful stores all had one characteristic in common. “The stores that have a little bit of plush here and there don’t work as well as the ones that make a really big statement with it whether it’s in a corner of their store or a display. Devoting some real estate and having some sort of color or theme statement really catches the eye.”

Aurora’s Waldmier notes that merchandising is also critical. While in the field doing market research, she noticed that successful stores all had one characteristic in common. “The stores that have a little bit of plush here and there don’t work as well as the ones that make a really big statement with it whether it’s in a corner of their store or a display. Devoting some real estate and having some sort of color or theme statement really catches the eye.”

Whatever your in-store strategy, experts agree making the sale starts at the door. “We have Frisbees that are safe to throw in the house, and our salespeople throw them to people when they come in the store,” Word states. “We get customers emotionally involved.”

Mouse over images below to view.